8 Real Estate Terms That Every First-Time Buyer Should Know

May 28, 2014

tags: Buying a Home, chris heller, heller the home seller, home buying, home buying checklist, real estate terms, real estate tips, real-estate, san diego real estate

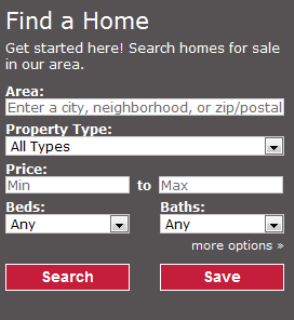

Once you’ve made the decision to start looking for your first home, you should know that the process isn’t instantaneous. Before you even begin looking online, visiting open houses, bidding on properties, and eventually closing — there is some homework we recommend you take care of first. You’ll notice that once you start working with mortgage lenders and real estate agents, they might begin throwing around industry jargon because it’s like their second language. We’re not saying you need to go back to school and get your real estate license, but you should at least be familiar with some of the more popular terms that are used. We’ll cover 8 of them today.

Once you’ve made the decision to start looking for your first home, you should know that the process isn’t instantaneous. Before you even begin looking online, visiting open houses, bidding on properties, and eventually closing — there is some homework we recommend you take care of first. You’ll notice that once you start working with mortgage lenders and real estate agents, they might begin throwing around industry jargon because it’s like their second language. We’re not saying you need to go back to school and get your real estate license, but you should at least be familiar with some of the more popular terms that are used. We’ll cover 8 of them today.

For more daily real estate advice, whether you are selling, buying, or just thinking about it, follow Heller The Home Seller on Facebook, Twitter and our brand new Pinterest account.

- 1. Debt-to-Income Ratio (DTI): The DTI is the percentage of your monthly gross income (before taxes) that goes toward paying debts, such as credit cards and loans. Not surprising, the lower your DTI, the better your chances of qualifying for a mortgage. Generally, you want to target a DTI of 36 percent or less.

- 2. Monthly Payment: Your monthly payment includes a portion of principal (amount of money borrowed or the outstanding balance on a loan) and interest. It also may include amounts for the escrow of taxes and insurance.

- 3. Interest Rate: Your interest rate is the cost of borrowing money expressed as a percentage. For example, if you borrow money at a 5 percent fixed interest rate for a year, the interest charged will be 5 percent of the total amount borrowed. Your interest rate, along with the term and loan amount, determines the size of your monthly principal and interest payment.

- 4. Fixed Rate Mortgages: With a fixed rate mortgage, your interest rate never increases. Even if rates go up, your rate will remain the same. This makes budgeting easier. Lenders generally offer fixed rate mortgages for 10, 15 and 30 years. The longer the term of your loan, the lower your monthly payment will be. With a shorter term, though your payment may be higher, you’re likely to build equity faster. Fixed rate mortgages are one of the most popular choices for homeowners, especially those who plan to stay in their home for many years.

- 5. Adjustable Rate Mortgages (ARM): With an ARM, you pay a lower, fixed interest rate for a set period of time. Then, the rate adjusts based on financial markets for the remainder of the loan term. As a result, your monthly payment could change as the interest rate changes. For example, a 5/1 ARM is fixed for the first five years, then adjusts every year thereafter. An adjustable rate mortgage may be a good choice if you’re confident that interest rates are likely to remain stable or go down in the future.

- 6. Annual Percentage Rate (APR): APR represents the total cost of borrowing money for a mortgage — including certain closing costs, interest, finance charges and points — over the full term of the loan, expressed as an annual rate. By helping you determine the true cost of your mortgage, the APR lets you compare different types of mortgages offered by different lenders. All lenders calculate the APR according to federal requirements and are required by law to provide the specific APR for your mortgage in the Truth in Lending disclosure.

- 7. Points: A point is a fee equal to 1 percent of your loan amount. You may be able to pay points, depending on the mortgage option selected, to lower your interest rate — these also are referred to as discount points. Alternately, you may be able to select a higher interest rate and receive a credit against closing costs. These are known as rebate points. The longer you plan on staying in your home, the more likely you are to benefit from paying points. To determine if paying points is right for you, you should calculate how long it will take for the initial cost to equal the savings you’ll realize through the reduction in your monthly payments. This is sometimes called a “break-even point.”

- 8. Amortization Schedule: This is a snapshot of how the interest and principal components of your loan change over time as payments are made. In the beginning, your interest component typically will exceed the principal repayment component. If you have a fixed rate mortgage, your monthly payment stays the same, but the portion of the payment that goes toward principal will increase over time. The interest portion of the payment is calculated on the scheduled amount owed each month.

A house is generally the largest investment that any person makes during their lifetime. Be sure that you are making the most educated decision possible. A great real estate agent will be there to guide you through the whole happy ordeal. If you’re ready to sell your home, have questions about your real estate needs, or you need a recommendation on who to work with while trying find a new home in the San Diego area — just contact Heller the Home Seller’s team today here at askhellerthehomeseller.com.

No comments yet